Owning inherited property in California can have financial implications.

Discover why and learn strategies to mitigate these costs.

It’s important to note that I hold a certification as a probate and living trust specialist from the California Association of Realtors. While I can offer general information, I cannot provide tax advice. Consult a tax specialist for personalized guidance.

Let’s start by understanding California property taxes, regulated by Prop 13.

This proposition establishes base values, limits annual assessments to a 2% increase, and caps property taxes at 1% of the assessed value.

For example, consider a residence purchased in Pleasanton for $200,000 in 1990. Its current tax base value in 2024 might be approximately $390,000, leading to annual property taxes of about $4,700 under Prop 13. If the same property were bought in today’s market for $1.5 million, the annual taxes would be around $18,000. This represents a savings of $13,000 attributed to Prop 13.

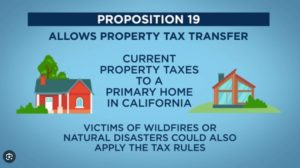

Now, inheriting property in California may lead to increased costs due to changes brought about by Prop 19, enacted on April 1, 2021. Previously, Prop 58 allowed parents to transfer their primary residence to their children without triggering a tax reassessment. However, Prop 19 modifies and limits these benefits.

The favorable aspect of Prop 19:

It allows eligible individuals aged 55 or older, those with severe disabilities, or victims of wildfires to transfer their property taxes when moving to a new home. However, certain rules apply, such as a three-time limit for homeowners, and the new property must be their primary residence.

The unfavorable part of Prop 19:

It replaces and limits the benefits of Prop 58 and Prop 193 for inherited properties. To benefit from the inheritance tax break under Prop 19, the property must be the parent’s or grandparent’s primary residence. Heirs have one year from the parent’s death to make it their primary residence, and they can only transfer up to a million dollars on the old tax base.

Not making the inherited property the primary residence within the specified timeframe triggers a reassessment at the current tax rate, leading to higher property taxes.

Factors like changes in the parent’s primary residence before their death can also impact property taxes.

If you’re considering selling an inherited property in probate or held in a living trust, feel free to contact me. I can provide a comprehensive property analysis report and discuss my four-step listing strategy to minimize stress and maximize sale proceeds.

Sincerely,

eXp Realty

Certified Probate & Trust Specialist

(925) 980-4603

DRE # 01861944

ALL MATERIAL PRESENTED HEREIN IS INTENDED FOR INFORMATIONAL PURPOSES ONLY. THE INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED THROUGH SOURCES DEEMED RELIABLE BUT CANNOT BE GUARANTEED AS TO ITS ACCURACY. SUBJECT MATERIAL MAY HAVE ERRORS, OMISSIONS, CHANGES OR WITHDRAWAL WITHOUT NOTICE. ANY INFORMATION OF SPECIAL INTEREST SHOULD BE OBTAINED